salt tax deduction california

150 part of a package to enact Californias 2021-22 budget. California Enacts SALT Workaround.

California Governor Signs Massive Package And Tax Bill

According to the Tax Foundation the.

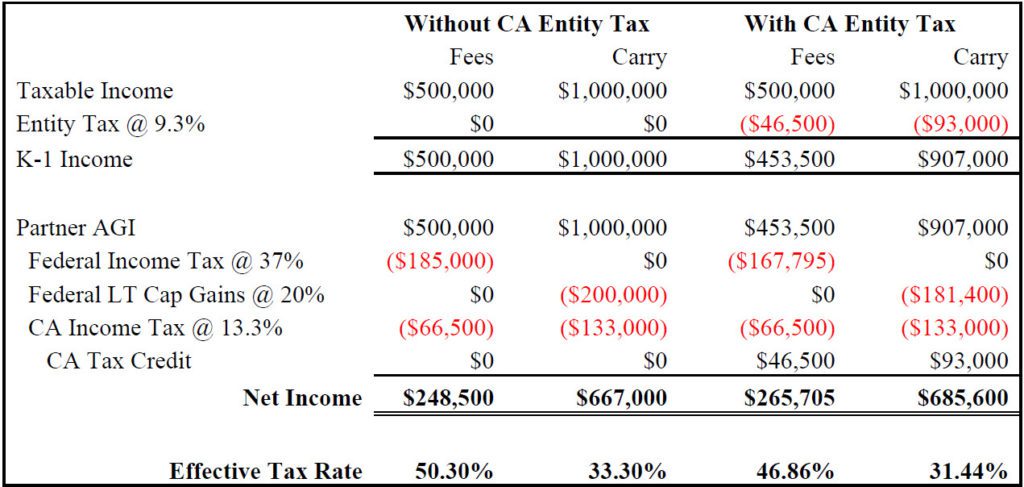

. California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. Thankfully the IRS gave its stamp of approval to these type of. For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of the amount of elective tax paid.

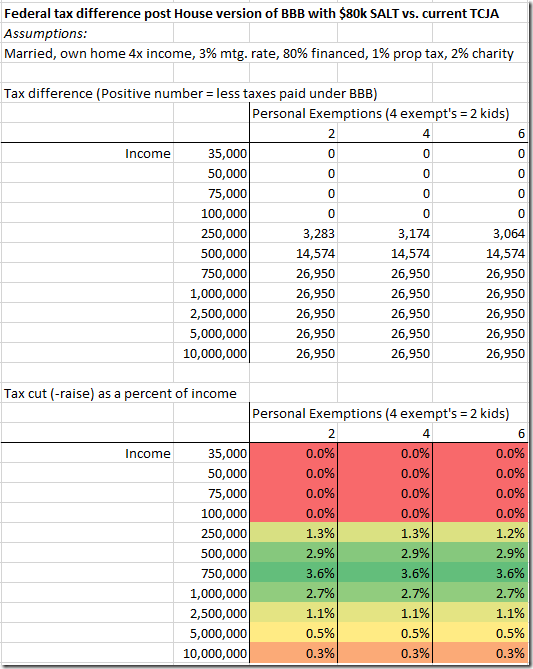

California SB104 seeks to. That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in the SALT deduction cap from 10000 to 80000 the. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill. Gavin Newsom a Democrat signed AB.

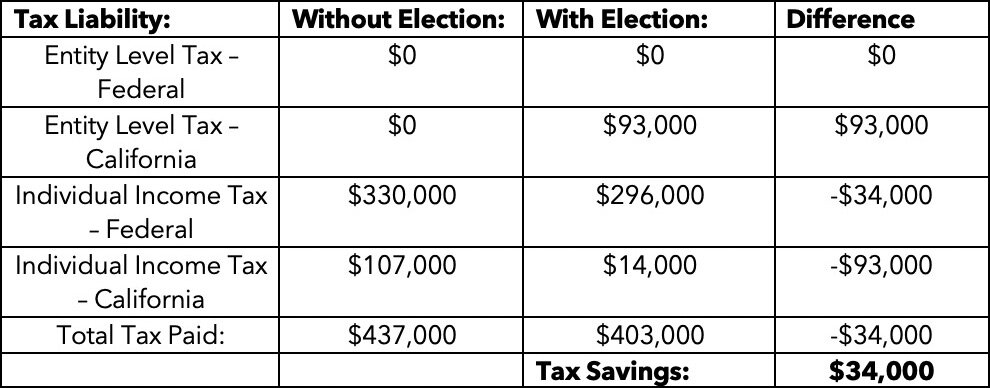

For example if the business has 1000 of profit income they would first pay 93 dollars in quarterlies as an elective tax and then receive a tax credit on the elected tax. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. Finally another consideration is whether the combined federal state and local tax burden is reasonable for the states most affected by the SALT deduction.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local. The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. July 29 2021.

Most people do not qualify to itemize. Tax legislation SB. Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the full amount paid in SALT taxes each year essentially avoiding paying taxes on their tax payments.

The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. Prior to the TCJA individual taxpayers were able to personally deduct 100 of the state and. California does allow deductions for your real estate tax and vehicle license fees.

In 2018 Maryland was the top state at 25 percent of AGI. California joined the growing list of states to create a workaround of the 10000 cap on the federal deduction for state and local taxes paid for pass-through entities under a bill signed Friday by the governor. On July 16 th the Governor signed AB 150 a budget trailer bill containing language outlining Californias PTE tax.

Following the Tax Cuts and Jobs Act TCJA passed in December of 2017 high tax states such as New York New Jersey and California have been working on legislation that would reduce the impact of the newly enacted state and local tax SALT deduction limitation. 113 signed by Governor Gavin Newsom makes several important tax changes including expanding the availability and benefit of the states pass-through entity PTE tax credit with most provisions taking effect during the 2021 tax year. Reinstating the net operating loss NOL deduction without limit for tax years beginning on or after January 1.

With the enactment of AB 150 Ch. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. California Passes SALT Cap Work-Around.

Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits. These taxes may be used by passthrough entity owners as a workaround to the 10000 SALT deduction limitation enacted by the TCJA. Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB.

On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass-through entities PTE from the current individual annual 10000 limitation on the deduction against federal taxable income for state and local taxes SALT paid. This article provides an overview of the California Pass-Through Entity Tax PTE which CPAs need. July 16 2021.

For many Californians and other taxpayers located in high-tax states like New York. Enacted by the Tax. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits.

California does not allow a deduction of state and local income taxes on your state return. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers.

Now SALT deductions are capped at 10000 the same for single and married taxpayers. 21-82 California has joined 16 other states that have now enacted an elective passthrough entity PTE tax. Overall the SALT deductions value as a portion of AGI fell between 2016 and 2018.

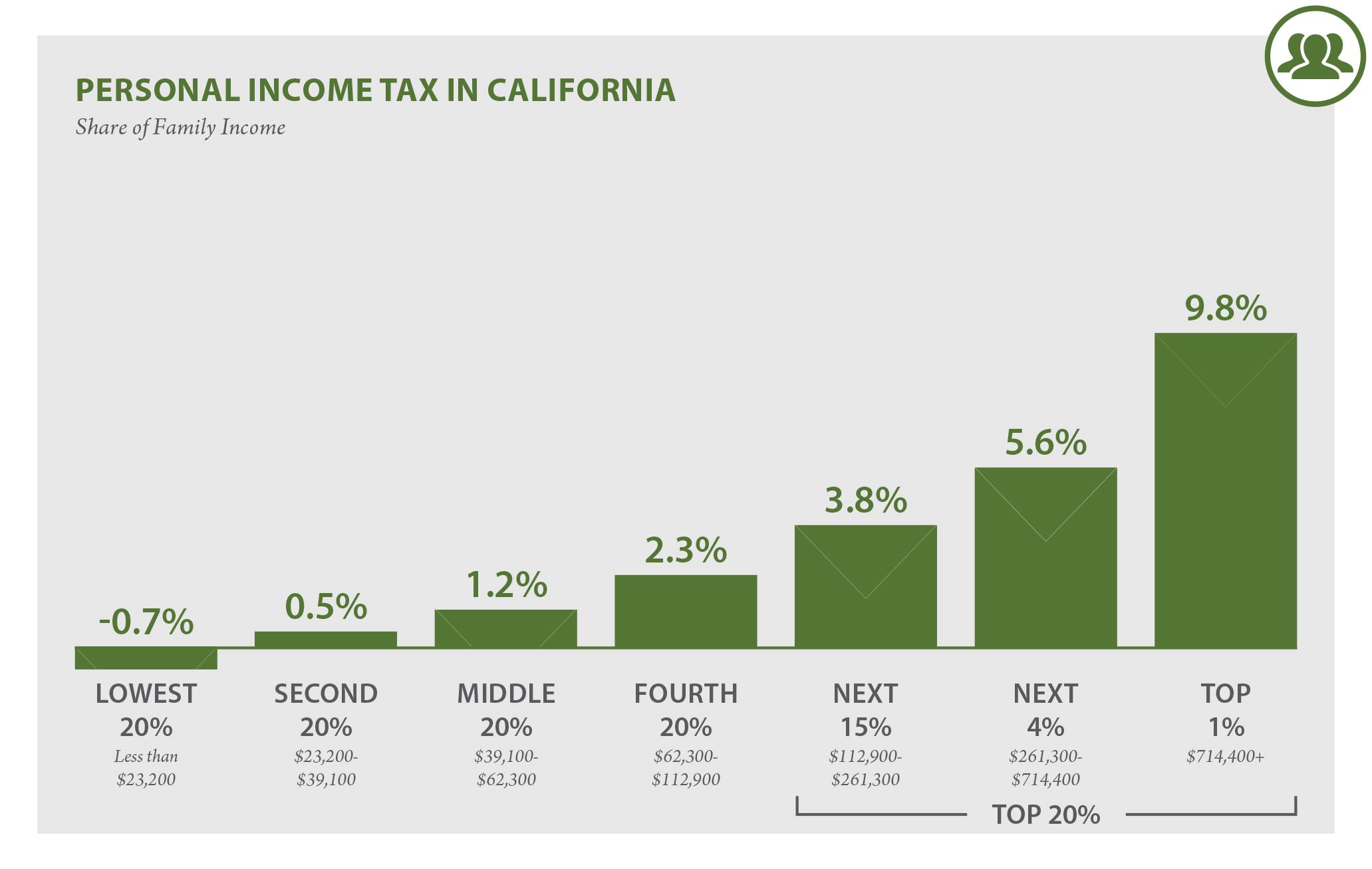

Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately. In California the deductions value fell from 81 percent in 2016 to just 18 percent in 2018. As you may remember the federal Tax Cuts and Jobs Act reduced the amount of the SALT deduction individuals can claim on their federal tax return to.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. California Joins States With SALT Cap Workaround.

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

California Pass Through Entity Tax Marcum Llp Accountants And Advisors

Congress Might Eliminate California State And Local Tax Deductions Here S A Look At The Numbers Orange County Register

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Opinion End Of Cap On Salt Deductions Would Help California Homeowners But Progressives Oppose Times Of San Diego

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

California Sidesteps The Federal 10 000 State And Local Tax Deduction Cap Hafuta Law

California Who Pays 6th Edition Itep

California Salt Cap Workaround Offered For Pass Through Entity Owners

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Final Gop Trump Bill Still Forces California And New York To Shoulder A Larger Share Of Federal Taxes Under Final Gop Trump Tax Bill Texas Florida And Other States Will Pay Less Itep

California Proposes State And Local Tax Cap Workaround

California Salt Deduction Archives Spreadsheetsolving

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

Poppy California Flower Bath Salt Flower Bath Floral Bath Salts Himalayan Pink Salt

Client Alert Gov Newsom Signs A B 150 Salt Workaround Shartsis Friese Llp